Digital Wallet and Its applications

Overview

Digital Payment Services are increasing in demand over the past decade. This growth has been fuelled by the penetration of low-cost smartphones and internet connectivity. E-commerce has picked up and gathered pace across the globe. Carrying cash or card has become a hassle especially while travelling. A single smartphone can be used for various digital wallets. This high time for businesses to develop wallets which will suit their needs and replace various payment processes for their customer. Smart organisations are implementing closed digital wallets within the company to reduce the usage of cash and card payments.

Digital wallet or E-Wallet

Digital Wallet is a platform or solution that offers users store electronic money and use them for various payments. The digital currency can be used for payments online and affiliated merchant stores.

There are various types of digital wallets available which a user must select for storing the money for performing any online transaction. The user can connect his payment cards or banking for transferring funds.

The online digital wallet has a software component that enables security and encryption. The platform has easy access features for storing user data, transaction details and payment options.

Types of Digital Wallet

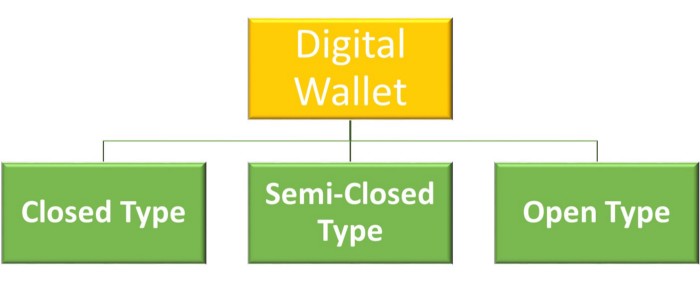

Digital wallets are classified based on the user base targeted by the company. They can involve different techniques and end points.

-

The closed type. These type of digital wallets are intended to use within the company ecosystem. A company can create an online store selling goods and services will need an online app for its customers. The wallet created by this company is a closed type if only can be used in its stores. The wallet is exclusive for usage by customers and employees within the company stores and online platform.

-

The semi-closed type.With the Semi-closed type, the customers have better options for using wallet money. The company can have an agreement with various sales outlets and the customers of the wallet can use within the ecosystem. However, the e-wallet coverage area is still rather limited.

-

The open type.These type of wallets can be used freely for paying goods and services. This type of wallet can be used for withdrawing and transferring funds.

Fiat and Digital Currencies

Fiat currencies can be described as an official currency of a country. Currencies such as dollars, euros, pounds, riyals, rupees, etc are type of fiat currencies. These currencies are legally authorised and backed by the sovereign. They can be traded across countries and tendered.

Digital currencies are various tokens and cryptocurrencies which are available online. They are stored in a digital ledger in cloud based distributed ledger, secured by cryptography. Digital assets such as Bitcoin, Ethereum, Ripple, Monero, Litecoin, etc are cryptocurrencies.

Blockchain based wallet has the advantage of allowing to use tokens, fiat currencies and cryptocurrencies.

Where Digital Wallets can be used?

Digital wallets are ideal payment methods that can be used for both online and offline payments. It allows making online purchases, booking flights, getting loans, peer to peer transfers, store payments, etc. Utilised digital currency can be withdrawn to bank account or transferred to another user.

Advantages of Digital Wallets

-

Easy Payment Process.The simplified payment process for quick payments in online stores and retail outlets. No hassles of change in cash transactions and complicated checks in card payments.

-

Lower assets and infrastructure costs.Digital wallets significantly reduce infrastructure costs and transaction costs.

-

Unlimited Usage period.The registered user can use the wallet and digital payment service for as long as the user intends without any maintenance charges as the cost of maintaining an account is negligible.

-

Faster Transactions.Electronic transactions and transfers can be executed in real-time or a few minutes depending on the type of transaction. Some bank transfers can take from several hours to a few days.

-

Secure Transaction.Blockchain and Encryption algorithms extend additional security to the transactions. Blochain offers immutable and secure transactions.

-

Online KYC/AML.Verify user online via KYC/AML. This can be performed by manual verifications of documents online or through API.

-

Increased Revenues. Having an exclusive wallet that can ease payment process will increase usage and retention of customers.

Disadvantages of Digital Wallets

-

Internet connection is mandatory for transactions

-

Need to have a mobile app or web interface to perform transactions. Increased internet and smartphone penetration has alleviated this issue.

Digital Wallet Interfaces

-

Mobile App Android and IOS mobile application is an important and one of the interfaces for using a digital wallet. The app can allow user to use the wallet in mobile smartphone for online payments and store payments

-

Web Based Web based wallet interface can be used in laptops, desktops, tablets and mobile browsers. The online stores can have a better store front in web and wallet usage can be eased.

-

NFC Mobile NFC payment can enable contactless payments at stores and restaurants.

-

IOT Automated digital payment for various items like pertrol, milk pouring, services can be done via IOT deveices.

-

Card Based Wallet maoney can used securely by card based payments

-

Smartwatch Enabled Smartwatches are being increasing used by customers for internet, calls, health monitors and importantly payments. It can be easily carried and scanned for payments.

-

QR Wallet QR scanners can used for identifying the wallet user via mobile and payments can be initiated.

-

SMS Based Payment can be initiated and validated via SMS transaction codes and OTPs.

Applications of Digital Wallets

Digital wallet has universal usage and can be used for diverse purposes.

-

Online Store Purchases

-

Payments for services like hotels, flights, tours, etc

-

Peer to peer transfers

-

Cross country forex payments

-

Loan payments

-

Property Purchases

-

Investments

Popular Digital Payment Solutions

-

PayPal PayPal Holdings, Inc. is an American company and one of the largest payment processors in the world. With PayPal, you can send, spend and manage your money with just one account.

-

Samsung Pay Samsung is a South Korean multinational conglomerate Samsung is one of the largest manufacturer of a wide range of home electronics. Samsung offers a host of financial services via Samsung pay. Use for payments and getting rewards.

-

Apple Pay This is a mobile payment and digital wallet service by Apple Inc. and American company that allows users to make payments in person, in iOS apps, and on the web. Apple Pay web support is limited to the Safari browser only. Apple pay is supported on the iPhone, Apple Watch, iPad, and Mac.

-

Paytm Paytm is a wallet system based in India. It enables e-commerce payment systems and financial transactions.

-

Amazon Pay Amazon Pay is an online payments processing service that is owned by Amazon. It was launched in 2007. Amazon Pay uses the consumer base of Amazon website and provides them option to pay in their website and merchant websites.

-

Google Pay Google Pay is a digital wallet platform and online payment system developed by Google to power in-app and tap-to-pay purchases on mobile devices, enabling users to make payments with Android phones, tablets or watches.

-

PhonePe PhonePe is a digital payment company headquartered in Bangalore, India. The PhonePe app went live in August 2016 and was the first payment app built on Unified Payments Interface (UPI).

Security Features in Digital Wallets

Biometric. Digital wallet systems can utilize biometric data of the user to validate transactions and payments.

Two Factor Authentication. Password and One Time Password in mobile or email can validate the user transactions

SMS OTP. Validate transactions and user actions via transaction password in SMS to the number of the wallet user.

Blockchain

Blockchain offers secure features such as common, consistent and immutable information. Various industries, companies and government organizations are adopting blockchain for decentralised database management (DLT), encryption and incorruptible data which brings in trust and transparency.

You can offer wallets and coins as loyalty points or tokens. Blockchain offer secure and immutable records. Platform owners can enable users on your platform to carry out transactions securely in both web and mobile apps. By using an exclusive solution, your customers can carry out transactions in your tokens, digital currencies and fiat currencies.

Future of Digital Wallets

Digital wallets help reduce paper and card-based transactions. Tokenisation, increased security, wider acceptance will increase the usage of digital wallets.

Read More Blogs

Blockchain based Herd Management Software for dairy farms and milk cooperatives

The cattle and herd management...

Learn More